What is a UPI app?

In regard To accept obligations on line, it is critical to offer customers an variety of payment choices. As indicated from the 20-16 Yearly Charging family members unit Review, customers start using an average of 3.6 varied payment procedures each month to their own bills. Today, customers possess greater payment selections accessible together with the progressions in computerized wallets and adaptive payment applications.

Offering Different charging and online payment choices builds fulfillment by strengthening customer expertise. Notwithstanding producing valuable ways to admit obligations, using a lot more alternatives can reduce the time that it takes your own enterprise to become paid. Many sellers find they spare some time when devoting installments safely above their mobile, website, versatile app, or by way of a mutual payment program that transports fees their client’s ledger or prices their own card record.

UPI Represents Unified Upgrades Interface (UPI). It enables the exchange of cash you start with just one bank-account afterward onto the next instantly using the mobile. Installments can be made through the applying on the mobile because it ended up. The money move by means of UPI bargains with 24×7 assumption.

To utilize UPI, you should really have a banking accounts with part financial institution, i.e., your lender ought to allow you to utilize the UPI office. A Part of the part banks incorporates Their State Bank of India (SBI), HDFC Bank, along with ICICI Bank.

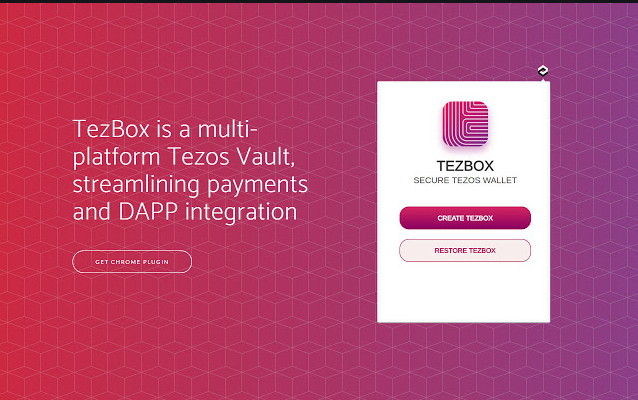

If You Have checked whether your bank UPI installations, you will need to get into the UPI supporting application in your PDA. A portion of the ordinarily utilized applications offering setup throughout UPI technique is BHIM, which are created by NPCI, also you’ll find some personal players far too, as an instance, Paytm, PhonePe, tezos Fundraiser, Google Pay, and Amazon Pay and so on. Remember , your mobile number needs to be enlisted with your own bank reflect the main reason behind affirmation to create easier and more secure internet transactions. Tezbox seems to be always a multiplatform to streamline payments in addition to normally takes the integration process.

Posted on December 28, 2020

Categories

Recent Blogs

- Best Live Casino Games for Real-Time Thrills

- Genie Casino: Magical Moments, Real Rewards

- Cut Costs, Not Quality: AquaTru Coupons You Can Trust

- Top Examples of Capital Expenses for Rental Properties

- Midland TX Electricians – Experts in Residential & Commercial Projects

- Navigate Online Deals with These Shopping Guides

- Discover Luxury Adult Toys at VELĀRE – Elevate Your Intimacy